2018-01-07

Mortgage Calculator using Apple’s Numbers Application

Buying a house could be one of the biggest purchases one made in their lifetime. Most people may not be able to pay their house using cash. It is time to shop for a mortgage.

Would it be great to know what you will be paying even before you look for a mortgage? If you happen to own any reasonably new iDevice or Mac product from Apple, chances is that you already have the application that you need for free: Numbers. This application, together with Pages and Keynote are originally part of the iWork office suite application created by Apple Inc. These applications can be downloaded from the App store.

This guide will show you how to easily calculate your mortgage payment using Numbers. In fact, Apple has provided template for calculating Mortgage in Numbers. In the other article, I will show you how to do this in Microsoft Excel. Although we talk about mortgage, this can be applied to any other type of loan as well.

Before you start, you may need to have some information available to you:

- The purchase price for your house. This usually depends on location, size of the house, the condition of the house, as well as other market condition. For example, if you already know the area where you want your house to be and you are looking for 2 bedroom house in this area; you could do some search and get the price range of the house.

- Usually, only some portion of the purchase price of the house can be borrowed, and you need to prepare some cash (or some other means) to pay the remaining deposit or down payment. Depending on the country, you may need to prepare between 10-40% as deposit or down payment.

- Other fee and expense. There may be some additional tax, fee, commission, etc. that you may need to pay related to the purchase of the house. Another consideration is the renovation cost for the new house. Although this is not needed in the calculation for the mortgage, this could be an important factor for your decision to purchase a house. Together with the deposit or down payment, this component determines the amount of cash you need to buy a house.

- The yearly interest rate for the loan or mortgage. You will need to check with the bank or financial institution in your area for the rate of the mortgage. Sometime the interest rate of the loan could be changing from time to time. We will cover this in another article. For now you can use the fixed initial interest rate for your initial calculation.

- Period of payment. How long do you plan to completely finish the payment of your mortgage? Depending on your age, the bank or financial institution may put a limit on how long you need to pay your mortgage or loan. For this exercise, you can try to use the longest time allowed for you.

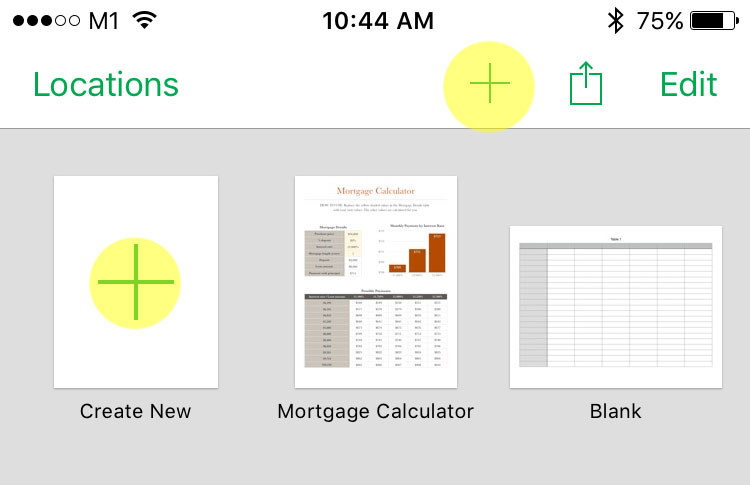

With this information available to you, you can now start using Numbers to calculate your mortgage payment. When you open the Numbers application, you will see something like this on your device screen (depending on the type of your device and your OS version):

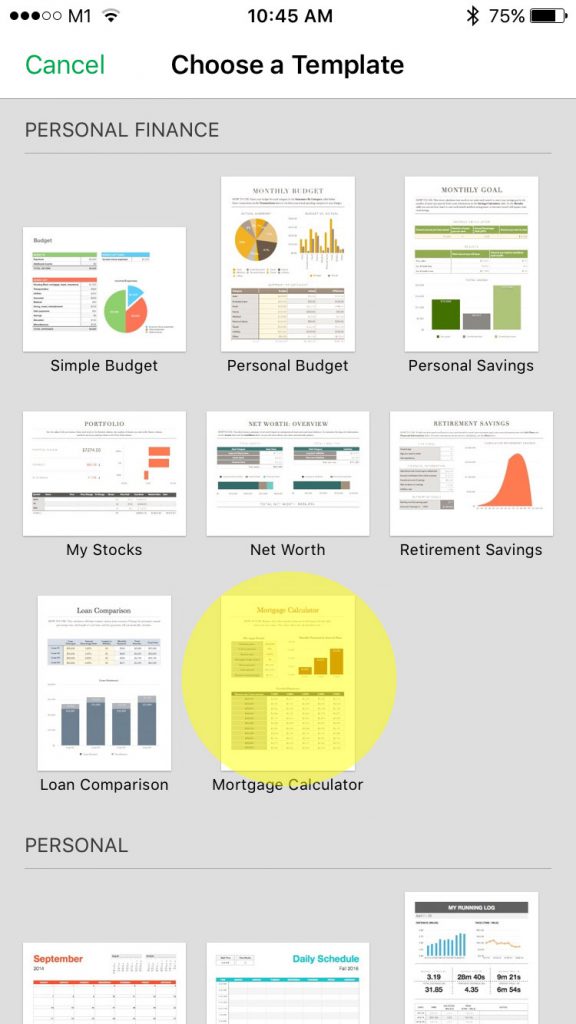

If you tap on the “Create New” or “+” button, you will see a list of template you can choose to create. Under the “Personal Finance”, you can select the “Mortgage Calculator” template.

You will now have your Mortgage Calculator document created for you. In this document there are 2 tabs; the Calculator and Monthly Data. When you first create the document, you will be in the Calculator tab. Under the Mortgage detail, there are 4 cells coloured differently; “Purchase price”, “% deposit”, “Interest rate” and “Mortgage length (years)”. You only need to fill in these 4 information and the application will compute the rest for you. NOTE: The “Interest rate” refer to the interest rate per year.

In the picture below, we entered purchase price of $10,000, out of which 20% must be paid by cash, with the interest rate of 12% per annum, with loan duration of 1 year. After we enter the information, the result will be computed automatically. Based on this information, the amounts of deposit we need to pay are $2,000, which means $8,000 is borrowed from bank, and we need to pay $711 per month in the period of the loan. This information is visible under the Mortgage Details.

The Calculator tab also displays various scenario of monthly payment for different loan amount and interest rate.

Additional Info

Under Construction.